FINANCIAL REVIEW

7

Interim Report 2016

Financial Performance

The Trust Group’s revenue and unaudited consolidated profit for the period ended

30 June 2016 were HK$5,326 million (2015: HK$5,232 million) and HK$1,101 million

(2015: HK$1,205 million) respectively.

Distribution

The Trustee-Manager Board has declared an interim distribution of HK19.92 cents

(2015: HK19.92 cents) per SSU for the six months ended 30 June 2016. In order

to enable the Trust to pay that distribution, the Company Board has declared the

payment of a first interim dividend in respect of the Company’s ordinary shares held

by the Trustee-Manager of HK19.92 cents (2015: HK19.92 cents) per ordinary share in

respect of the same period.

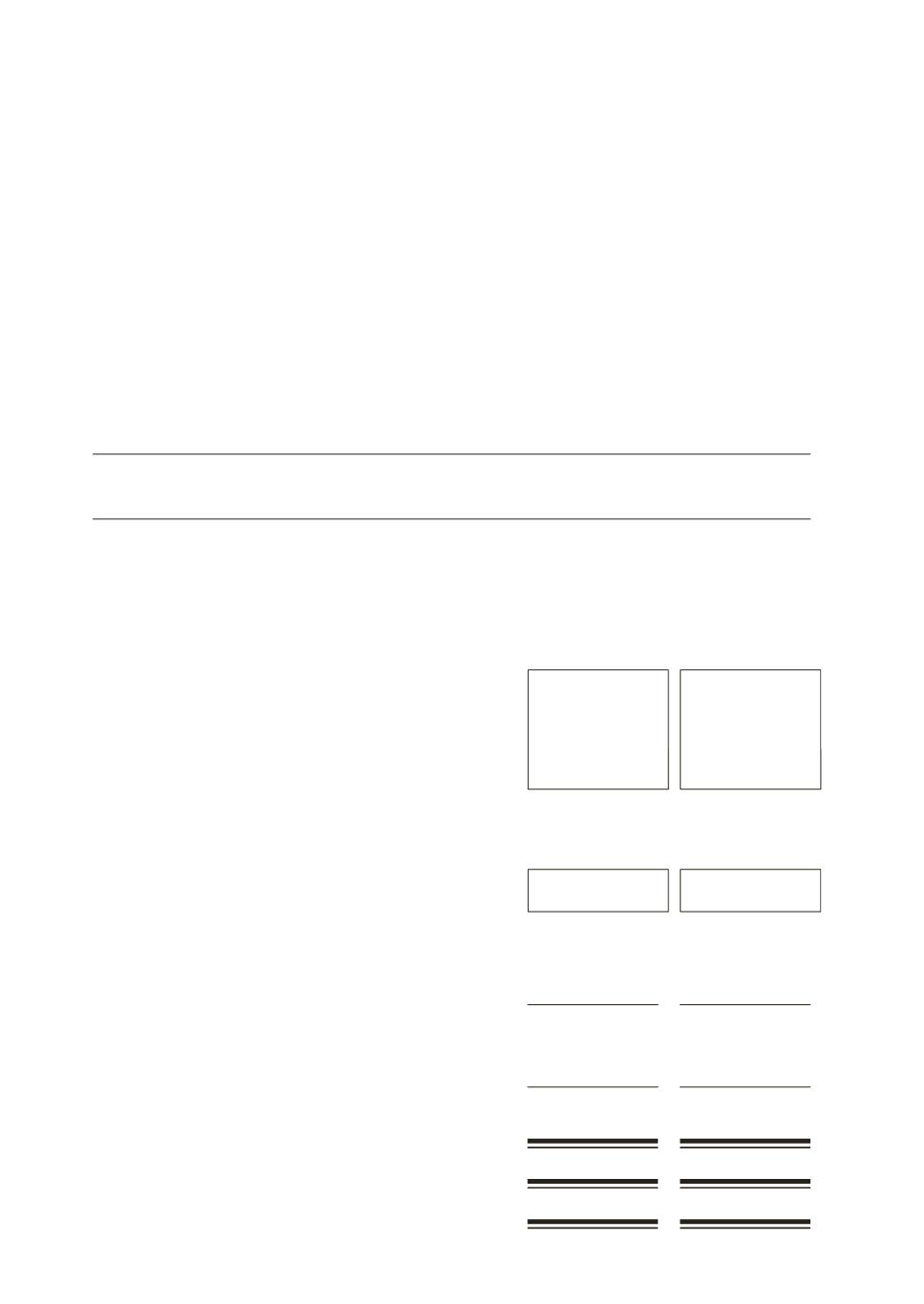

Six months ended 30 June

2016

2015

HK$ million

HK$ million

Consolidated profit attributable

to SSU holders for the period

1,101

1,205

After:

(i)

eliminating the effects of the Adjustments

(see note (a) below)

2,742

2,611

(ii)

adding/(deducting)

– movement in Fuel Clause

Recovery Account

979

775

– changes in working capital

(423)

(478)

– adjustment for employee retirement

benefit schemes

12

8

– taxes paid

(233)

(238)

335

67

(iii)

capital expenditure payment

(1,340)

(1,099)

(iv)

deducting

– debt repayment

(6,296)

(520)

– net finance costs

(639)

(485)

(6,935)

(1,005)

(v)

deducting

– reserve for future capital expenditure/

debt service

(439)

(19)

Distributable income for the period

(4,536)

1,760

(vi)

adding discretionary item

– early repayment of debt during the period

6,296

–

Distributable income after adjustment of

discretionary item

1,760

1,760

Distribution amount for the period

1,760

1,760

Interim distribution amount per SSU

HK19.92 cents

HK19.92 cents